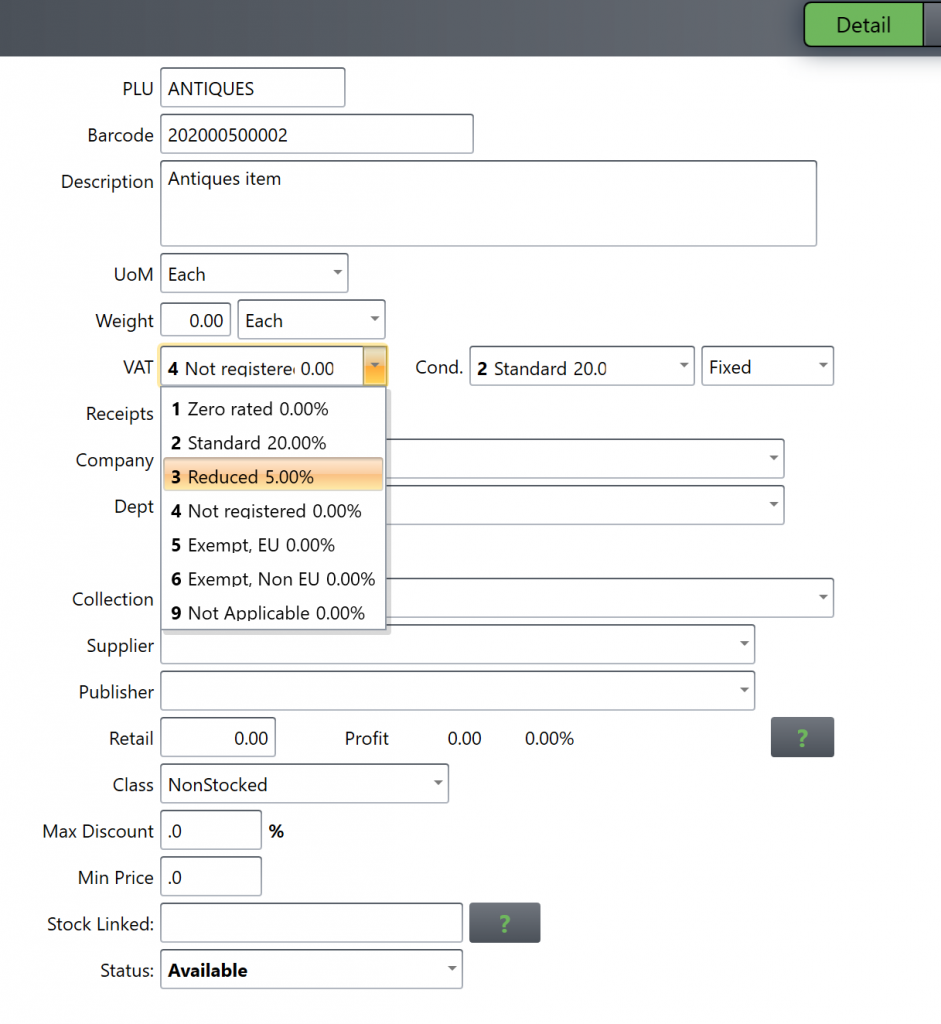

On 8/7/20, the government announced a change in VAT rate for certain situations. To change the VAT rate of any applicable products, press your edit product button in tengoPOS or type in \\PROD and press enter – you will be presented with the following screen, where you can change the given product to be reduced rate VAT, as shown. You may also as appropriate wish to change the retail price, please note retail price is INCLUSIVE of VAT – so a £12 item that was 20% VAT rate, if you are passing on the saving to your customers should be set to £10.50 retail price if you are changing it to 5% VAT rate.

If you don’t have a reduced rate VAT code on your system or wish to call this new VAT rate by another name, you can add/edit VAT codes by typing in \\LVAT and pressing enter in tengoPOS.

Please note – you will need to have the relevant user rights to perform the above functions, usually these are set to Administrator level.