Introduction

Our systems integrate with HMRC so that you can make Gift Aid submissions very easily using TengoCloud (if no-one in your charity has access to tengoCloud, contact us).

PLEASE NOTE: You MUST make your Gift Aid claims through the system and not try to do it outside of the system, to ensure compliance with HMRC legislation. The system automatically applies all rules and regulations, and checks method A / B limits and cooling off periods before completing a claim, submitting data from our system through another method bypasses these checks, sometimes resulting in invalid claims and duplicate claims being made.

Process

Log in to tengoCloud as normal and find the Gift Aid tab. Hover over this and move down to Pending, and click.

Above is the Header bar, the date range defaults to today. You can change the range of dates and click the magnifying glass symbol to search – but see below, it is not necessary to type in dates if you want to make a submission of all eligible lines.

The Pending tab will list only those lines available since the last submission to HMRC, i.e. not lines already Submitted or Failed

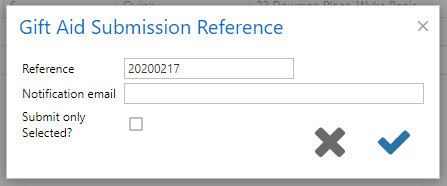

Click on the HMRC button with the Up arrow, near the top right hand corner, and the following box appears –

- The reference will default to the format shown – the date 1 month prior. This is because you can not claim Gift Aid on transactions less than 1m old, in case the donor / customer changes their mind about Gift Aid. (HMRC rule). tengoPOS automatically suppresses these ineligible lines. The Reference can be changed, this may depend on whether you tick the “Submit only Selected” box, see below.

- The email address can be left blank, HMRC will contact you on the email address you have registered with them.

- If you leave the “Submit only selected” box blank, every eligible line since the last submission and up to 30 days ago will be submitted, including any previous Failed lines that have been repaired, e.g. Post Code was missing. PLEASE NOTE – HMRC have a 30 day cooling off period for new donors / donations, so anything less than 30 days old will not be submitted.

- If you tick the box, only those lines you have on your screen within the chosen date range will be sent (30 day rule as above still applies).

- When you are satisfied, click the blue tick to send the submission.

An email acknowledgement should be received promptly from HMRC, if the submission is succesful.

When HMRC have approved the submission, the status of the lines will change from Pending to Submitted, or maybe in some cases, Failed.

HMRC Details

As a Registered Charity or CASC you will already have an account with HMRC, with a Username and Password. Our software is directly integrated with HMRC to enable direct submissions to them. Prior to the first submission, we will need the following information from you. The information you give us should match exactly what HMRC have on file for you, otherwise they will reject Gift Aid submissions. You can send the information to us using the secure form below, it will then be encrypted within your database on our servers. If you have updated anything with HMRC you will need to use the form below to update our side as well, and the full form needs to be completed each time as it is a single encrypted file.

Gift Aid information and the submission function are currently only available together in TengoCloud. You will already have a user name and password for this, and additional licences are available if required.

Further Guidance

Frequency of claims – There are no hard and fast rules about when you should make Gift Aid claims, it is up to your organisation whether these are monthly, quarterly etc. You can not make more than 1 submission in a 24h period, and as already mentioned lines from the last 30 days are suppressed.

Other Gift Aid screens – On the Gift Aid tab –

- List – enables you to find any entries irrespective of Status (Pending, submitted, failed). Using the date ranges and then filtering the data allows you to analyse the information quickly. e.g. to find out how many GA eligible sales were made last week, input the date range from and to, click the Search symbol.

- Pending – we have looked at above, all GA eligible lines that have not been submitted yet

- Failed – Submitted to HMRC but rejected. See full guide on this here.

- Submitted- a list of submitted and accepted lines

- Submission Summary – A one line summary of your submissions. Note the end columns are blank as we are not aware what has been paid to you. Note the Value shown throughout, is the value of the sales made, not the expected amount of additional Gift Aid income as a result of those sales.