Each year, you must send an email or letter to every donor who’s donated items have generated £20 or more of sales (and each 3 years for those who have sales but not £20 or above).

TengoCloud Charity CRM makes the process of sending the letters extremely simple (if no-one in your charity has access to tengoCloud, contact us). At the end of the tax year, the system automatically produces a list for you of all the people you need to contact with email addresses and postal addresses, and the amount to add in to the letter – you can then export this and use it for email/mail merging the letters.

You can find this list under ‘Gift Aid’, and by clicking on ‘Donors Requiring Contact’. Be sure to choose the correct tax year from the drop-down – you have from 6th April until the 31st of May to complete the process of sending your letters/emails out for the previous tax year. It is always worth waiting a few days after the 6th of April to allow time for any missing data to upload, and if you have a large number of Gift Aiders, for the calculations to be made. Our data starts making the calculations on the 6th and for large charities it can take a day or 2 even to complete this task.

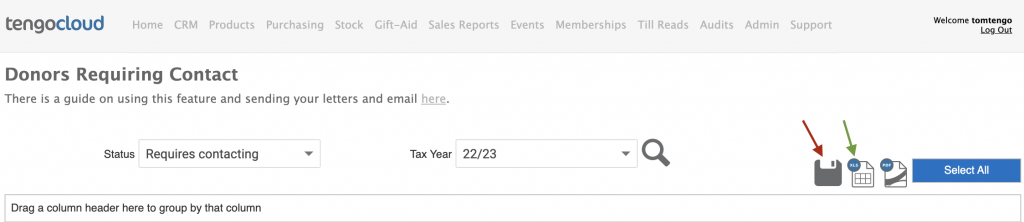

This page and menu is shown below.

To generate your mailing list, press the magnifying glass next to the Tax Year dropdown. This will generate the mailing list with figures. If you have a lot of Gift Aiders, this process may take some time, so please be patient and don’t click away from the page. Once you see the list of names, addresses, and amounts, press select all (blue button) and then the Excel icon (indicated above by the green arrow. Then use either HMRC’s letter template (provided by HMRC charities) or your own modified template, and mail merge the spreadsheet that will have downloaded when you pressed the Excel button. There is a guide from Microsoft on using mail merge here. Once you have posted your letters, go back to the report for the same tax year, press select all, and click ‘save’ which is indicated above by the red arrow.

When you press save, the records are marked as ‘Awaiting contact’, and after 21 days any that you have not manually altered will automatically be cleared so that Gift Aid can be submitted for them.

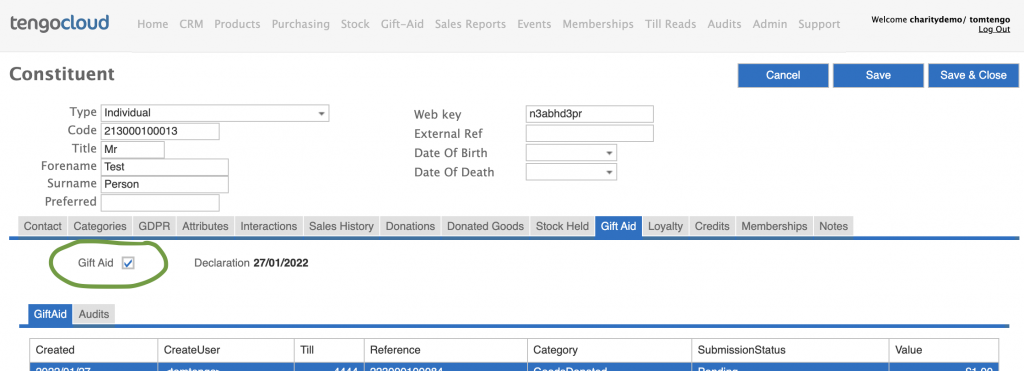

If you do get someone replying to you who states they are no longer happy to Gift Aid, you need to edit their record to state this, and no further submissions will be made for that donor. You can do this in both tengoPOS and tengoCloud – in tengoPOS, you may have a ‘donor lookup’ or ‘find customer’ button. You can also access this function by typing in \\FCUS and pressing ENTER on your screen or keyboard. In tengoCloud, you will find the same under CRM > Constituents. In both cases, search for the donor in question, select them, click edit, and on the Gift Aid tab, un-tick ‘Gift Aid’. The tick box is shown below circled in green. PLEASE NOTE: During the 21 day period this is a little counterintuitive, ALL records will have Gift Aid unticked because they are not allowed to Gift Aid until the 21 days elapses or they contact you. So to manually de-list someone for Gift Aid during this time, you have to first tick the box, then untick it again. It will ask you for the audit how the instruction was received.

No further manual intervention is needed, after 21 days all donors where you have not manually registered a response will automatically be eligible to be part of a Gift Aid claim, which can be done in the normal way. The guide on making submissions is here should you need it.

Once your letter process is fully complete, it’s also a good idea to clear any errors on the failed report, as Gift Aid that was attempted to be claimed whilst someone was previously requiring their letter, will be listed there. There’s a guide here (press the reset button).